If you’ve ever wondered whether travel insurance is actually necessary, trust me—you’re not alone. As an Independent Travel Manager, I’ve met thousands of travelers from all over the world, and one thing I’ve learned is this:

People only realize the true value of travel insurance on the day something goes wrong.

Until then, it feels optional.

Like an add-on.

Something you “might” need but will “probably” skip.

But after years of helping clients plan trips, handle emergencies abroad, and navigate unexpected travel challenges, I’ve seen enough real-life stories to tell you confidently:

Travel insurance is one of the smartest—and most affordable—parts of a trip.

In this guide, I’m sharing 10 real scenarios where travelers wished they had travel insurance, plus tips to choose the right policy and protect your journey with confidence.

Let’s dive in.

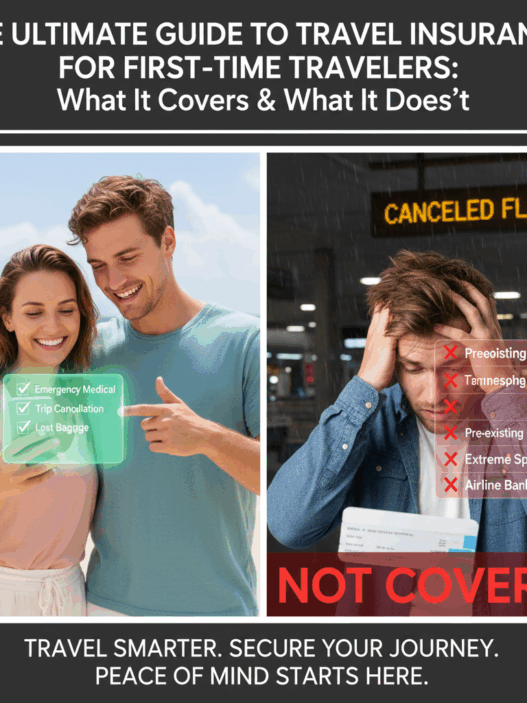

What Travel Insurance Actually Covers (and Why It Matters)

Most travelers understand that travel insurance is “for emergencies,” but they don’t always know what it truly protects.

Here’s what a good policy typically includes:

1. Trip Cancellations

If your flight is canceled, your visa is denied, or something forces you to cancel your trip, insurance reimburses you.

Considering today’s unpredictable airlines, this is essential.

When booking your flights through trusted partners such as Aviasales, always consider adding travel insurance for full protection. You can explore flight options here:

👉 Aviasales

2. Medical Emergencies Abroad

This is the BIG one.

A hospital stay overseas can cost thousands—or tens of thousands.

Travel insurance ensures:

- Hospital bills are covered

- Emergency treatment is paid for

- You don’t drown in medical debt while on vacation

3. Lost or Delayed Luggage

Airlines lose luggage every single day.

Insurance helps replace:

- Clothes

- Valuables

- Personal items

- Essentials

4. Trip Interruptions

If you must return home early for an emergency, insurance covers unused travel expenses and extra travel costs.

5. Emergency Medical Evacuation

This can cost over $100,000 without insurance.

With insurance, it’s fully covered.

6. Travel Assistance Hotline

Most travelers don’t know this, but insurance includes:

- 24/7 support

- Help finding hospitals

- Translation

- Emergency arrangements

7. Adventure & Activity Protection

Jet skiing, hiking, snowboarding, ATV rides…

Most basic policies don’t cover these—but specialized policies do.

⭐ 10 Real Situations Travelers Wish They Had Travel Insurance

Let’s get into the stories that will make you think twice about traveling without insurance.

1. The Missed Connecting Flight Nightmare

A traveler from New York had a short layover in Paris on the way to Greece.

The first flight got delayed.

He missed the connection.

The airline said:

“We can put you on the next flight — in 2 days.”

Hotels, food, and rebooking fees came out to nearly $600 out of pocket.

A simple travel insurance policy would have reimbursed everything.

2. A Stolen Passport in Barcelona

One of my clients was pickpocketed her second day in Barcelona.

Her passport, cash, and cards… gone.

She spent:

- €120 on passport replacement

- €85 on transport

- 2 full days of vacation lost

With travel insurance, all of this would have been covered AND she would’ve gotten emergency cash assistance.

3. Lost Luggage on Arrival

Landing in Thailand, excited for an island getaway, one traveler discovered that her luggage was still in Dubai.

She had:

- No clothes

- No swimsuits

- No toiletries

- No personal items

She spent around $350 buying replacements.

Insurance would’ve paid for all of it.

4. Medical Emergency in Bali

A man got food poisoning so severe he needed IV treatment.

The private hospital asked for payment upfront.

Total bill: $620.

With insurance?

= $0.00

5. Natural Disaster Cancels a Trip

A client planning to visit Japan during typhoon season lost the entire trip when flights were grounded.

With insurance, all her costs — flights + hotels — would’ve been refunded.

6. Airline Cancellation With No Refund Options

Budget airlines are notorious for this.

One traveler booked a cheap flight to Italy. Weeks later, the airline canceled the route and offered only a voucher — not helpful for someone who only travels once a year.

Insurance would’ve refunded the flight cost cash-in-hand.

7. The Classic Vacation Injury: Broken Ankle

A traveler fell down stairs in her Santorini hotel.

The medical bill?

X-rays + treatment = $1,800.

Insurance would’ve covered the entire cost plus transportation.

8. Hotel Closure Upon Arrival

Believe it or not, this happens often, especially with small hotels.

A traveler arrived in Mexico only to find the hotel in renovation, with no rooms available.

Insurance would’ve covered:

- new hotel

- transportation

- losses

9. Getting Sick Right Before the Trip

Imagine paying for:

- flights

- hotels

- tours

- transfers

…then getting the flu two days before departure.

Without insurance?

= You lose everything.

With insurance?

= Full refund.

10. Emergency at Home Forces Trip Cancellation

A traveler had to rush home because of a family emergency.

Without insurance, the remaining hotel nights and tours were lost money.

Insurance would’ve refunded everything.

How to Choose the Right Travel Insurance Policy

As a Travel Manager, here’s the advice I always give:

1. Determine What Type of Traveler You Are

Are you:

- an adventure traveler?

- a family traveler?

- a budget traveler?

- a digital nomad?

Each category needs specific coverage.

2. Compare Policy Details Carefully

Some cheap policies don’t cover:

- adventure sports

- evacuation

- full baggage protection

A good comparison tool is essential.

You can explore reliable options here:

👉 Ektatraveling

3. Check Medical Coverage Minimums

At least $50,000 is recommended.

For Asia or the US, even more.

4. Look for 24/7 Assistance

This is non-negotiable.

When you’re stranded at 2 AM in another country, this hotline is your best friend.

5. Read the Exclusions

Not all plans cover:

- pregnancy issues

- extreme sports

- pre-existing conditions

Real Stories From My Clients (Names Changed)

💬 “Prince, thank you for telling me about travel insurance. When my luggage got lost in Dubai, I was reimbursed in 48 hours!”

— Sandra

💬 “My son broke his wrist in Bali. The bill was huge, but travel insurance saved us.”

— Michael

💬 “We had to cancel our honeymoon because of COVID. Insurance refunded everything — flights, hotel, tours.”

— Rita & John

These are the stories that show how powerful insurance really is.

Final Advice as Your Independent Travel Manager

Travel is one of the best gifts you can give yourself.

But safe, protected travel?

That’s priceless.

Travel insurance is not just an add-on — it’s peace of mind.

Before you book your next flight, explore options through trusted partners here:

✈️ Aviasales And compare reliable insurance plans here:

🛡️ Ektatraveling Travel smart.

Travel safe.

Travel protected.