Introduction: Your First Trip, Your First Lesson — Always Protect It

Planning your first international trip is exciting — the bookings, the destinations, the outfits, the photos you’re already imagining for Instagram. But as an Independent Travel Manager who has worked with thousands of travelers, I can tell you that one thing many first-time travelers overlook is travel insurance.

Some think it’s an unnecessary expense.

Others believe nothing “bad” will happen.

And some simply don’t understand what it really covers.

But travel insurance is not just protection — it’s peace of mind. And for first-time travelers, this peace of mind can make your experience smoother, safer, and far less stressful.

This guide breaks down exactly what travel insurance covers, what it doesn’t, why you need it, and how to choose the best plan — with real-life examples from travelers who learned the lesson the hard way.

Let’s get started.

⭐ What Exactly Is Travel Insurance?

Think of travel insurance as a safety shield for your trip.

It protects your money, your health, your belongings, and your travel plans when something unexpected happens.

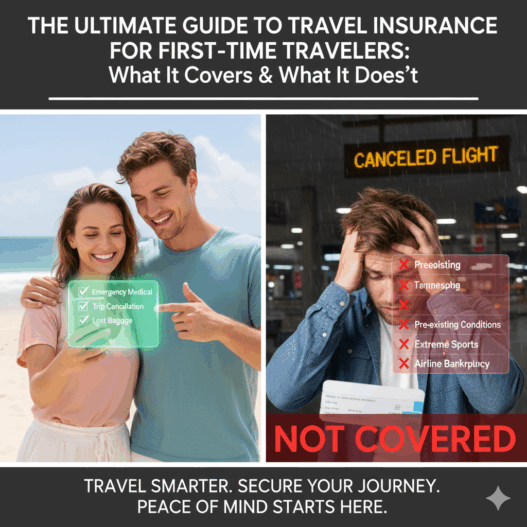

Most policies cover:

- Medical emergencies

- Canceled flights

- Delays

- Lost baggage

- Trip interruption

- Emergency evacuation

- Personal liability

- 24/7 global assistance

And yes — it’s often cheaper than your airport lunch.

⭐ What Travel Insurance Covers (Explained Simply)

Let’s break this down in a way first-time travelers will understand easily.

1. Medical Emergencies Abroad

This is the most important part.

Most countries do not treat foreigners for free.

A simple hospital visit can cost $300–$1,000.

A serious injury? $5,000–$50,000.

Emergency evacuation? Over $100,000.

Travel insurance covers:

- Emergency treatment

- Hospital stays

- Doctor visits

- Prescriptions

- Ambulance services

Real Example:

A traveler in Bali suffered dehydration and needed IV treatment.

Total bill: $600

Insurance payment: 100% covered

2. Trip Cancellation Before Departure

If something unexpected forces you to cancel your trip, insurance refunds your:

- Flights

- Hotels

- Tours

- Activities

- Transfers

You are covered for reasons like:

- Illness

- Family emergency

- Natural disasters

- Visa issues

- Airline strikes

This is especially important when booking flights. When you’re searching for affordable flights on platforms like Aviasales, consider pairing it with travel insurance for full protection.

✈️ Book smart: Aviasales

3. Trip Interruption After You Arrive

If you need to return home early due to an emergency, insurance refunds the unused part of your trip and helps pay extra transportation costs.

This is a lifesaver for:

- Family emergencies

- Sickness

- Passport loss

- Injuries

4. Lost, Delayed, or Damaged Luggage

Airlines mishandle luggage every single day.

Insurance pays for:

- Clothes

- Essentials

- Toiletries

- Replacement bags

- Personal items

Real Example:

A traveler’s bag was lost on her way to Thailand.

Insurance reimbursed her $300 for essentials within 48 hours.

5. Flight Delays or Cancellations

If your flight is delayed for hours, insurance covers:

- Meals

- Hotels

- Transportation

- Rebooking fees

If your flight is canceled?

You get refunds for everything affected.

6. Emergency Medical Evacuation

This is for serious cases where you must be transported:

- to another hospital,

- another city,

- or even another country.

Evacuation without insurance can cost $25,000 to $150,000.

With insurance? = $0.

7. 24/7 Travel Assistance Line

This is one of the hidden superpowers of travel insurance.

You get help with:

- Locating hospitals

- Translating languages

- Flight rebooking

- Emergency arrangements

- Legal assistance

- Local support

Think of it as having a personal travel safety team in your pocket.

⭐ What Travel Insurance Does Not Cover (The Truth Most Don’t Know)

This part is very important — especially for first-time travelers.

NOT covered in most standard policies:

❌ Pre-existing medical conditions

(Some plans offer this as an add-on.)

❌ High-risk extreme sports

Unless you buy adventure coverage.

❌ Reckless behavior or alcohol-related incidents

❌ Unattended baggage theft

(If you leave your bag alone intentionally.)

❌ Routine medical treatment

Such as check-ups.

❌ Non-refundable visas (in some countries)

❌ Traveling against government warnings

This is why comparing policies is crucial.

You can explore and compare good options here:

👉 Ektatraveling

⭐ Types of Travel Insurance: Choose What Fits YOU

First-time travelers often buy the wrong type because they don’t know the difference.

Here are the main categories:

1. Single-Trip Travel Insurance

Perfect for:

- Students

- Vacation travelers

- Honeymooners

- Family trips

Covers one trip only.

Affordable and simple.

2. Annual Multi-Trip Insurance

Great for:

- Frequent travelers

- Business travelers

- Digital nomads

One payment covers all trips in a full year.

3. Medical-Only Travel Insurance

For those who:

- Have flexible travel plans

- Book cheap flights

- Only want health protection

Often chosen by backpackers.

4. Adventure or Sports Insurance

Designed for:

- Skiing

- Surfing

- Hiking

- ATV riding

- Scuba diving

- Snowboarding

Standard insurance does NOT cover these.

5. Student or Long-Stay Travel Insurance

For:

- Exchange programs

- Gap year students

- Internship trips

- Study abroad programs

⭐ How to Choose the Right Policy (Beginner-Friendly Guide)

Choosing a travel insurance plan shouldn’t feel like decoding rocket science.

Here’s how I guide my own clients:

1. Consider Your Destination

Countries like:

- USA

- Japan

- Singapore

- Switzerland

…have very high medical costs — you need stronger coverage here.

2. Consider What You Will Do

Are you:

- Relaxing at a beach?

- Backpacking?

- Riding ATVs?

- Snowboarding?

Activities matter.

3. Check the Medical Coverage Amount

Minimum recommended:

- $50,000 USD worldwide

- $100,000 USD for USA, Japan, UAE, Singapore

4. Check Baggage Coverage

Especially if you’re carrying:

- Cameras

- Electronics

- Designer items

- Laptops

5. Look for 24/7 Emergency Assistance

This is non-negotiable.

6. Compare Plans Before Buying

Don’t pick the first plan you see.

Use a reliable comparison tool like this one:

👉 Ektatraveling

⭐ Real-Life Examples First-Time Travelers Can Learn From

These stories come from clients I’ve personally supported.

1. Emily’s First Trip to Europe — Broken Phone, Lost Bag, Delayed Flight

Emily was excited for her first trip to France and Italy.

But within 48 hours:

- her flight was delayed 7 hours

- her luggage was lost

- and she dropped her phone in Venice

Total potential costs:

- New clothes: $180

- New phone: $500

- Meals during delay: $40

With insurance?

= Everything reimbursed.

Without insurance?

= A very expensive first trip.

2. James’ First Solo Trip — Food Poisoning in Thailand

James was a first-time traveler who assumed he wouldn’t get sick.

On day 3, he ended up in a hospital with severe food poisoning.

Bill:

- ER treatment: $280

- Medication: $60

- Tests: $140

Insurance covered 100%.

He now buys insurance every single trip.

3. Maria’s Honeymoon Cancellation

Maria and her fiancé were set for Bali.

Two days before departure, her fiancé tested positive for COVID.

Without insurance, they would’ve lost:

- Hotel: $900

- Flights: $1,200

- Tours: $300

Insurance refunded it all.

They rebooked two months later — stress-free.

⭐ When Should First-Time Travelers Buy Travel Insurance?

This is the trick many beginners don’t know:

👉 Buy travel insurance immediately after booking your flights or hotel.

Why?

Because:

- Early cancellations

- Airline schedule changes

- Visa issues

- Natural disasters

…can happen before your trip even begins.

You can find good flight deals first here:

✈️ Aviasales

Then get your insurance right away.

⭐ How Much Does Travel Insurance Cost? (Easy Breakdown)

Most first-time travelers are surprised at how affordable travel insurance really is.

Typical cost:

👉 4–8% of your total trip budget

Examples:

- $500 trip → $20–$40 insurance

- $1,000 trip → $40–$80 insurance

- $2,000 trip → $80–$160 insurance

It costs far less than a new smartphone…

And protects FAR more.

⭐ How to File a Claim as a First-Time Traveler

It’s easier than you think:

✔ Step 1: Keep all receipts

✔ Step 2: Take photos of lost or damaged items

✔ Step 3: Request airline or hotel documentation

✔ Step 4: Submit everything online

✔ Step 5: Get reimbursed

Most insurers pay within 5–14 days.

⭐ Final Advice From Your Travel Manager

If this is your first trip abroad, here’s my honest advice:

💡 Travel insurance is not about expecting something to go wrong.

It’s about knowing you’re protected if it does.

Whether you’re booking your first flight or planning a dream trip, be smart and travel safe.

Find trusted flights here:

✈️ Aviasales

Compare quality insurance plans here:

🛡️ Ektatraveling Travel confidently.

Travel wisely.

Travel protected.