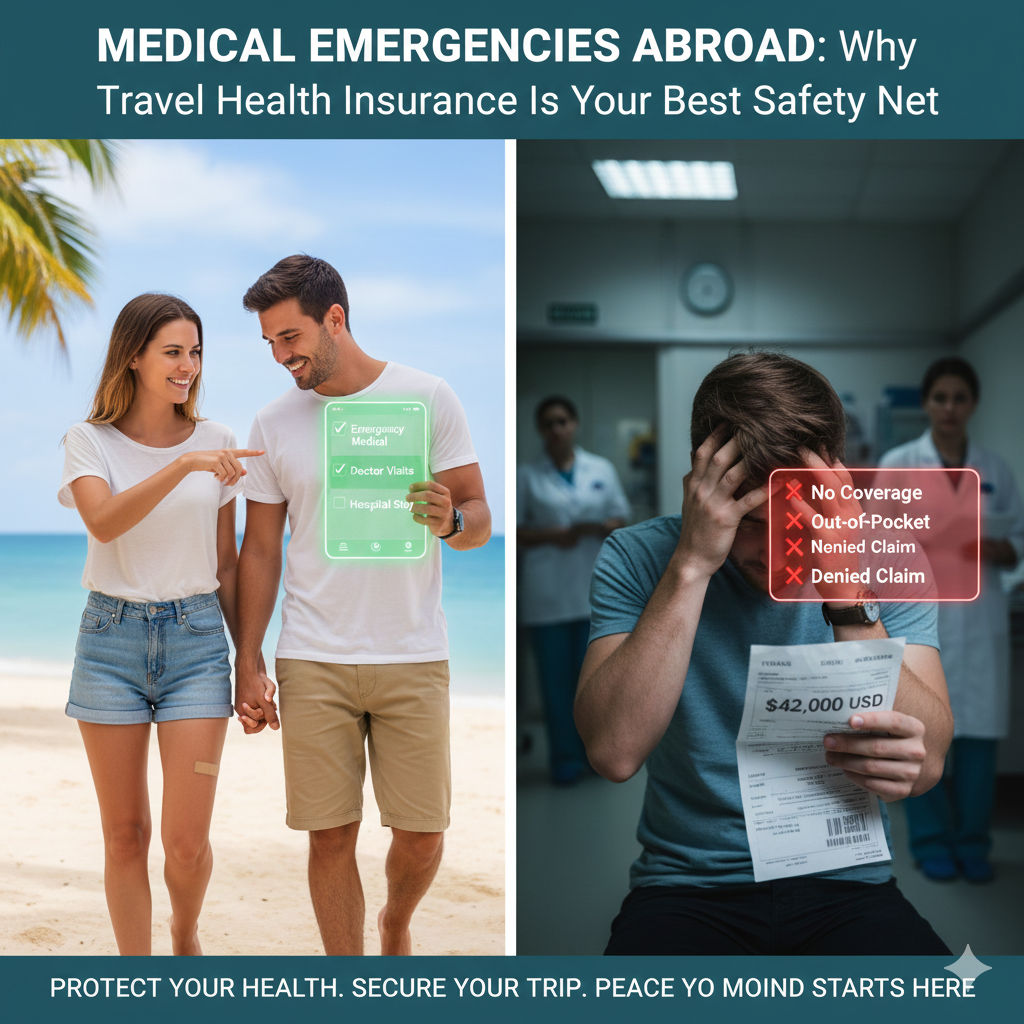

Traveling is about the “unforgettable”—the views, the food, the people. But as a Travel Manager, I know the other side of “unforgettable”: the $6,000 hospital bill for a fever in Bali or the $14,000 cost of a slipped trip in Dubai.

We often plan our outfits and itineraries with precision, yet leave our physical well-being to “luck.” In 2026, with global healthcare costs rising, luck is not a strategy.

🛑 The Reality Check: Why Your Current Plan Isn’t Enough

Most travelers make a dangerous assumption: “I have insurance at home; I’m fine.” Here is the truth from the industry:

- The Border Barrier: Most domestic health plans stop providing coverage the moment you cross international borders.

- The “Resident Only” Rule: In many countries, “free” or subsidized healthcare is strictly for citizens. As a tourist, you pay the “private” rate—which is often staggering.

- The Evacuation Nightmare: If you are injured in a remote area and need a medevac, costs can range from $10,000 to over $200,000.

🏥 The “High-Cost” Zone

If your 2026 travel plans include any of these destinations, travel health insurance is non-negotiable:

| Country | Average Cost for Basic ER Visit | Potential Broken Bone Cost |

| USA | $700+ | $15,000 – $25,000 |

| Singapore | $400+ | $10,000+ |

| Switzerland | $500+ | $12,000+ |

| Japan | $300+ | $8,000+ |

🔍 Travel Insurance vs. Travel Health Insurance

Many clients get these confused. To travel like a pro, you need to understand the difference:

- Standard Travel Insurance: Protects your wallet (Flights, baggage, cancellations, delays).

- Travel Health Insurance: Protects your life (Hospital stays, surgery, emergency evacuation, prescription meds).

Pro-Tip: I always recommend a “comprehensive” policy that bundles both. It ensures that if you’re hospitalized, you aren’t also worrying about your lost hotel deposits or missed return flight.

🩹 Real Stories from the Field

In my years as a Travel Manager, these two cases stand out:

- The Bali Fever: A client spent $50 on a policy. Two days later, they contracted Dengue Fever. The $6,027 hospital bill was paid entirely by the insurer.

- The Dubai Slip: A traveler broke his leg near the Dubai Fountain. Between surgery and the ambulance, the bill hit $15,700. His out-of-pocket cost? $0.

📋 The Manager’s Checklist: What to Look For

Before you sign off on a policy, ensure it hits these 2026 standards:

- High Limits: At least $50,000–$100,000 in medical coverage (Higher for the USA).

- Emergency Evacuation: This must be included to avoid bankruptcy in a crisis.

- 24/7 Assistance: A “hotline” that actually answers when it’s 3:00 AM in your time zone.

- Adventure Sports Rider: If you plan on hiking, skiing, or scuba diving, you usually need a specific “add-on.”

✈️ How to Book Smart in 2026

I tell all my clients the same thing: Secure your flight, then immediately secure your safety.

- Find the best routes: Use Aviasales to compare reliable flight deals globally.

- Lock in your safety net: Use Ektatraveling to find comprehensive travel health protection that fits your specific destination.

🌟 Final Advice

Travel Health Insurance isn’t about being “afraid” of what might happen. It’s about freedom. It’s the freedom to explore a night market in Thailand or a trail in the Swiss Alps knowing that if the unexpected happens, you are taken care of.

Don’t let a medical “hiccup” turn into a lifelong debt.

Travel smart. Travel safe. Travel protected.