Travel is one of the few industries where the consumer often has the least control over the final product. As an Independent Travel Manager, I’ve planned thousands of dream vacations. But I’ve also been the “emergency line” at 3:00 AM when a connection is missed in Istanbul or a suitcase vanishes in Rome.

The reality of modern travel is simple: It’s no longer a matter of if a disruption occurs, but when.

The 2026 Travel Paradox

Airports are more crowded, schedules are tighter, and airline margins are thinner than ever. This creates a “domino effect”: one mechanical delay in London can cancel a tour in Dubai.

What I see most often:

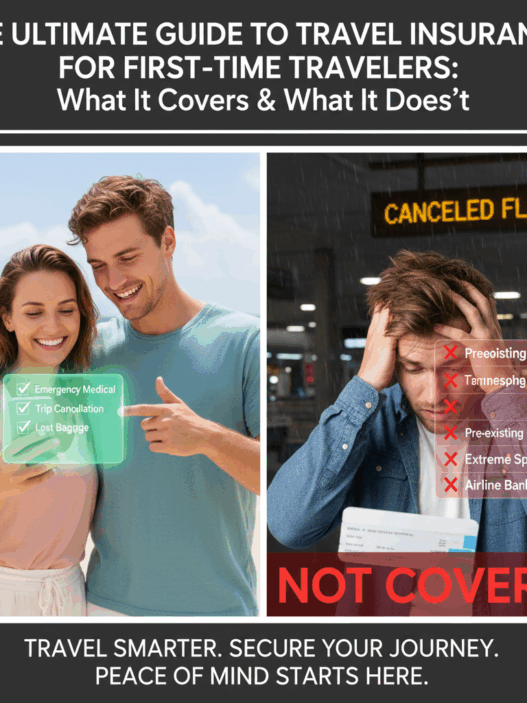

- The Vanishing Suitcase: Millions of bags are mishandled annually. Without insurance, you’re spending your vacation budget on emergency toiletries and overpriced airport clothes.

- The Missed Connection: A 45-minute delay on Leg A can cost you $2,000 in last-minute rebooking fees for Leg B.

- The “Hidden” Cancellation Costs: Airlines might refund your ticket, but they won’t refund your non-refundable boutique hotel or your pre-paid desert safari.

The “Credit Card” Myth

Many clients tell me, “I’m covered by my credit card.” Professional Tip: Usually, you aren’t—at least not fully. Credit card coverage often has low limits, excludes “acts of God” (weather), and lacks the 24/7 human support needed during a crisis. Standalone insurance is a specialized shield, not a secondary perk.

My Manager’s Checklist for 2026:

- Book Smart: Use reliable aggregators like Aviasales to find the best routes.

- Protect Early: Secure your policy the moment you book your flights via Ektatraveling.

- Document Everything: Keep every receipt and get written proof of delays from the airline.

Bottom Line: Travel insurance isn’t about betting that something will go wrong; it’s about ensuring that when it does, it’s merely an inconvenience, not a financial catastrophe.